Invest in Crude OIl And Gas

Clear & Competitive Pricing

Maximize your potential with straightforward pricing and exceptional trade executions.

Real Time Market Analysis

Stay ahead of price action with access to actionable market insights, real time trade signals and more.

Professional Trading Platforms

Trade with maximum control on our advanced investment platforms made for just for you.

SWIFTROYALS

OIL INVESTMENT

You don’t need to move to Texas and buy a well to start investing in oil. You don’t even need a lot of money.

SwiftRoyals funds make it easy for beginners to invest in oil and oil-related investments — without having to relocate to the Lone Star State.

There are several ways to invest in oil, and most don’t include owning any physical oil yourself. You can invest in oil-related stocks, oil mutual funds and oil futures

OIL STOCKS

Oil stocks are shares of companies involved in the extraction and production of petroleum. You’ll want to research a company thoroughly before buying its stock. Note that it’s generally a good idea for the majority of a portfolio to be invested in mutual or index funds — which we’ll talk about below — rather than individual stocks, due to the diversification that funds provide.

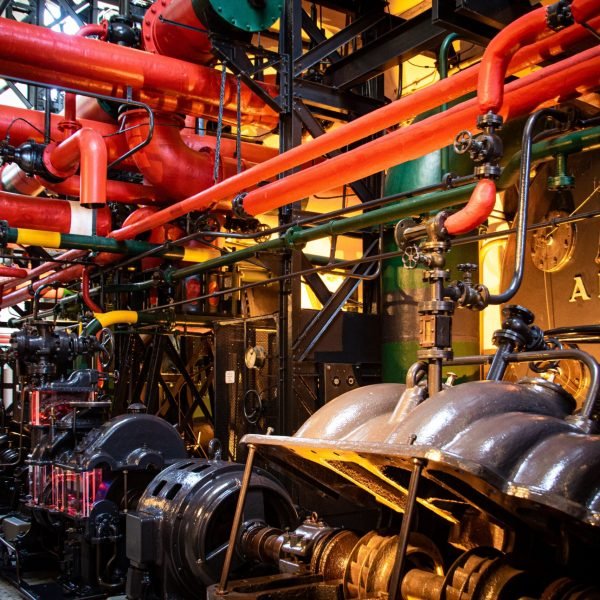

swiftroyals oil investment

1. Upstream oil and gas: also known as exploration and production companies, or simply E&Ps, explore locations around the world for oil, and, once they discover it, drill wells to extract it from below the ground or seafloor. E&Ps are the most susceptible to fluctuations in the price of oil. The largest E&P in the U.S. is ConocoPhillips

2. Midstream: transport, process, and store crude oil, natural gas, natural gas liquids (NGLs), and refined petroleum products such as lubricants. Midstream companies often do business using fixed-rate, long-term, or take-or-pay contracts. Thus, their profitability is less affected by oil price fluctuations. The master limited partnership Enterprise Products Partners

3. Downstream companies: refine crude oil into other products like fuel or petrochemicals or sell refined products to consumers. Some do both. Gas station operators and refinery operators are two types of downstream companies. The price of oil impacts refineries’ profitability because they make their money on the “crack spread,” meaning the difference between the price of oil and the price of refined products. As such, downstream stocks often take a hit when oil prices fall since lower demand for refined products is one of the things that can weigh on crude prices. Phillips 66

Crude oil and gas

Daily Live Chart on Some Crude Oil and Gas